Short Critical evaluation of Pakistan’s Fiscal Policy and Banking System

We know development as the phenomena through which the gross national product of the country increases but in today’s world that is not the real development because if you are not developing your society as a whole you will not survive in the world . So in order to develop in this world you need to develop the education system ,social system, political system and economic system which in turn will improve the human resources, and new technologies will develop as the consequence which will develop the country in the real terms.

Development should be measured in terms of social development and not in the dollar amount that is education, health , infrastructure , poverty, and other things .

As for as pakistan’s development is concerned, we have spent 50 years and still not achieved the state of self sufficiency though it be any sector we are lagging behind. There are certain reasons for it. We always went for the solution without identifying the problem and whenever we were in trouble we approached the monetary agencies through USA or some other countries. When pakistan came into being ,economic conditions at the outset of arrangements were almost without exceptions, dire. Country had debilitating underlying problems, severe institutional weaknesses, fiscal indiscipline , and weak external competitiveness. Whenever we wanted to develop anything we went to IMF world bank and other donor agencies. These monetary agencies also put some restrictions and conditionalities. More intense your problem is more intense their involvement will be not only in your economic system but also in the legal and political system.

IMF was established to encourage international monetary cooperation, contribute to expansion and balanced growth of the global trade, and to contribute thereby to the promotion and maintenance of high levels of employment and real income, assist member countries in correcting their mal-adjustments in their balance of payments through the general resources of the fund temporarily available to them under adequate safeguards and promote foreign exchange stability.

There is sufficient evidence to suggest that the standard prescriptions of the IMF and other donor agencies, ignoring the local as well as the human factor are not only ineffective but even counter-productive in some cases. Due to fudging of figures and some window dressing at the end of the fiscal year actual impact of the conditionalities is even more difficult. It is important to keep in mind that the overall impact of IMF conditionalities on the economy of a country could be negative but the program itself has been declared successful because it has achieved its goals.

Every time we go for the loans and aids, we face some more tough conditions and surprisingly, every time we succeed in obtaining a loan, it is claimed that IMF has given a clean bill of economic health to the country. There is no point in claiming the success in getting the tranche but we should look into the problem that is why do we need to go to IMF for each and every sort of development.We should try to preserve our economic and political sovereignity, save our society from the negative effects of these conditionalities.

Some common points to consider are :

- The developing countries are being made further dependent on the rich industrially developed countries under the banner of trade liberalization and globalization. As these developed countries charge higher prices for their raw materials hence making our products noncompetitive in the market.

- IMF conditionalities have not helped in improving the economic situation but it has also aggravated the inequality in the society as unemployment has increased in developing countries.

- Though the decisions in the IMF are carried through a voting system but Fund is mainly controlled by the rich industrialized countries.

- The stabilization policies of the IMF are often viewed as measures designed to maintain poverty and dependence of the poor countries while present iniquitious global market structural program for the benefit of the industrial world.

IMF has been pressurising the government to devalue its currency, reduction in the tariff rates and imposition of heavy taxes on the masses to reduce the budget deficit.It has however also asked for the recovery of the defaulted loans, increase in the documentation and the elimination of corruption, imposing the agricultural tax is also a very much discussed issue. IMF has also proposed the privatization of some state owned institutes and downsizing in some of the institutes but all these conditions should be met only and only when country is benefiting in the real terms.

Debt is an unmixed blessing.it is a two faced phenomenon. One face looks forward to achieve economic well being and prosperity through increased production, lowered unemployment and raised standard of living. While the other face sets eyes on the economic disaster as a sequel to recession, unemployment and hyperinflation. Thus debt is both a blessing and a curse, deciding factors being its size, trend, cost, nature, purpose etc. the question that arises at this stage is what should be done to set the things right? In order to get the response to this vital question, one has to first look into the causes of such a chronic unrestrained indebtness and its effects on our economy. Once these causesand effects are recognized, the remedies shall automatically emerge as a natural corollary. All the weaknesses which can make a nation’s debt unmanageable are there in our system.

These are:

FISCAL IMBALANCES:

Pakistan have been suffering from fiscal imbalances for quite some time, but it has reached the level at which it can be sustained no more.So for government is resorting to imposition of taxes, borrowings and printing of currency notes. As our tax base is very narrow and most of the people in the country don’t pay taxes at all, so it is a desirable step. As we are basically an agricultural economy and the imposition of farm tax should be implemented as soon as possible.Borrowing and printing of notes should be kept at the lowest possible level as these meet the budget deficits in an unhealthy manner. Government borrowings crowd out private investment from the money market. This result in the reduction of production, increase in unemployment, and rise in the inflation. This incresed borrowings also increase the interest rates, economic growth rate decline and the debt burden increases.

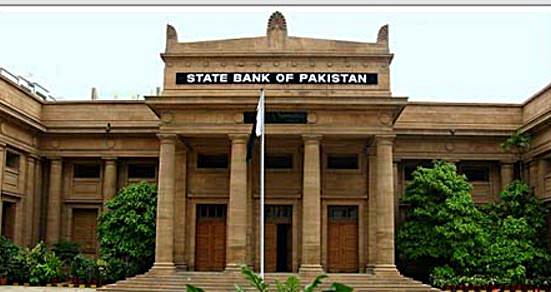

BANKING SYSTEM:

Pakistani bankers wre the best lot. They were in high demand in the international market, and enjoyed respect at home because of the fact that they are artful.Problem is with the banking system and the way it is regulated but not with the bankers.Major factors which affect the most are the influence of politicians and bureaucrates. This can be eliminated by privatizing these nationalized banks but the privatization process itself should be clear.Recoveries of classified debts should be enforced. Regulatory laws can also be revised to take the defaulters to the task. Complete autonomy should be given to the SBP to enable it to make viable profesional decisions independent of political influence and without undue regard to governments convenience.

EXCHANGE RATE SYSTEM:

Rupee exchange rate is neither fixed nor it is free to operate in relation to the some major currencies of the the world. It is a float based on the basket of currencies of our major trading partners, and the value of rupee is fixed by SBP in reference to the value of these currencies. While adopting this system it was claimed that regulating the exchange value of rupee matching its market value would be easier and instantaneous but because of the big difference between the hundi rate and the official exchange rate it is not achieved.

CURRENT ACCOUNT DEFICIT:

The current account deficit is increasing year to year. As we are unable to reduce our imports and we are also unable to increasing our exports because of low production base. We only rely on textiles and cotton for our exports and it is very susceptible to the natural and climactic factors .We need to increase our export base and try to export some new product categories.

INVESTMENT AND SAVING RATE:

Rate has always been low in pakistan because of low literacy rate, low per capita incomes at all times, cultural and social factors and inadeqyate facilities to attract and mobilise surplus funds. A low saving rate leads to low investments and if the gap between the two is large then the gap is filled by the borrowing. Substantial increase in the domestic savings rate by taking care of the deficiencies enumerated above may play a vital role to iron out the country’s financial indiscipline.

Other factors which are responsible for the high debt are lack of adequate database, corruption, large unproductive expenses and poor insurance. It is no denying a fact that our debt burden has reached the stage where one straw can break the back. It is high time to join hands to deal with the issues relating to the nature and magnitude of our public debt with determination.

By taking some firm and drastic measures the economy can be taken out of the oxygen tent. We must cut our current expenditure and raise revenues to balance our economy.

- pakistan is spending about $2.0 billion annually on the imports of wheat, edible oils, dry milk, pulses and other food items. By adopting policies to develop agriculture, live stock and dairy industry, pakistan can remove this item from the import list.

- A sincere and effective drive should be launched for the austerity from the top. Expenditure on establishment such as huge size committees should be curtailed.

- Thoughthe infrastructure plays a key role in the development of any country but looking at our case grand and high profile projects like new airports, motorways,should be shelved for the time being.

Critical evaluation:

In previous years there has been a trend of exploitation of the poor and less developed nation by the developed countries in one way or the other. It may be done with the poor technology transfer or having trade embargoes or supporting some politicians to give them the power to rule the country to make some decisions in their favor. Developed countries have been claiming the support and foreign aid but the question arises that whether the aid given to these countries was real or not.

In previous years nations and businesses had a view that resources should be used effectively and efficiently but now need is shift the view from using the resources to growing the resources. As we all know that we have limited resources so it will cause great problems for not only the third world but also for the developed countries.

We have heard of mergers and outsourcing between the businesses, these have been effective in one way or other so now the need is of pooling the resources between the countries and get the maximum benefit not only for their own country but to the overall society as well.

Many countries have been in competition for the market share of their products but we should tend towards the cooperation rather the competition. Through cooperation we do not mean the creation of monopolies.

Global environmental challenges like green house gases and ozone depletion will be the key issues for whole of the world so it is the responsibility of the developed nations to improve the environmental conditions and save this planet.

Developed countries have been given aid I n the form of sources and project financing which has proved to be ineffective because real resources are not being transferred to the third world, which includes human resources and other things.

As Pakistan is a third world country and its development has receded in the past years as more and more debt has been accumulated like other third world countries, so in order to improve the overall standard of life not only in Pakistan but also throughout the world, we need to have some sort of mutual understanding and cooperation.

World s becoming a global village so all the countries are closely knitted with each other and wrong policies in one country can hinder the progress of others. So there is a need t find a solution which would be beneficial for not only the developing nations but also for the developed one, so that we can make this planet a better place to live in.

As theories of economics are changing and new era of economic development has to start so we have to find the exact solution to the problems faced by the world in general and third world in particular.

In previous years it has been seen that MNC’s have targeted the rich and they have always tried to create monopolies. So now they have to invest in the social sector. Most countries try to get as much foreign investment in the dollar terms but actually these investments cause great loses to them in the long run as the net inflow is negative because these companies are not reinvesting in these countries.

These MNC’s have to change their operations, be more ethical and change their attitude towards self-interest rather than having selfish interests.

Institutional organizations and monetary agencies have to change their attitude towards these countries. Government has to play a vital role in not only getting the resources but to use it effectively and try to grow the resources. Local authorities will have to coordinate with the government. Law enforcing agencies will have to work with their full strength to reduce the factors, which go against the social development .eg. Crime.